We live in an era of instant gratification. We tap screens to purchase cars, tap our phones to buy groceries, and choose streaming instead of driving to a movie store. However, when it comes to protecting the things you have worked hard for: your car, your home, and your health: the process still feels outdated. Instead of simplicity, you must find a broker, complete endless forms, and sign up for policies you never realized you needed.

Integrated banking insurance breaks down these walls and guarantees your insurance process prioritizes safety and security. Rather than treating insurance as a headache-inducing chore, this model places protection directly where you already manage your money. As a result, the future becomes a unified financial ecosystem where your insurance lives right next to your checking account.

What Is Integrated Banking Insurance?

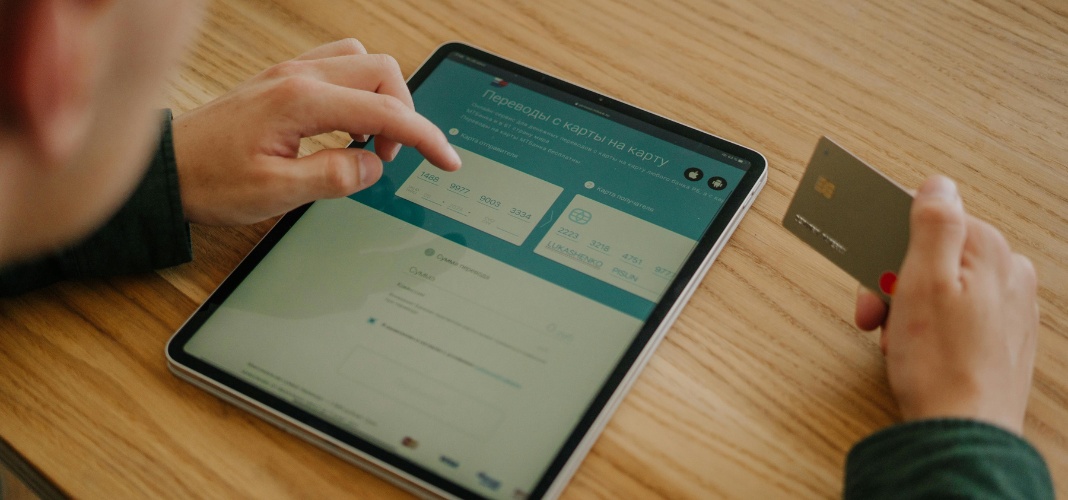

At its core, integrated banking insurance embeds insurance products directly into your everyday banking experience. Instead of a teller handing you a brochure for a third-party provider, your bank delivers a digital-first experience. Insurance offers appear exactly when you need them, powered by the financial data you already generate.

For example, suppose you apply for an auto loan inside your banking app. Once the bank approves the loan, the app immediately asks, “Do you want to insure this vehicle for $85/month?” You tap “Yes.” The system deducts the premium automatically from your account. At the same time, the app stores the policy documents under the “Documents” tab. Consequently, you avoid phone calls, duplicate forms, and repeated data entry.

In short, integrated banking insurance merges the purchase of an asset with the protection of that asset.

How Integrated Banking Insurance Benefits You

The Convenience

We are steadily moving toward an app-driven economy. As a result, consumers no longer tolerate juggling paperwork across multiple platforms. Instead, they want a single place to manage their finances. Apps that integrate banking and insurance allow you to view your entire financial picture: assets, liabilities, and protections, from one dashboard. Therefore, you gain clarity without complexity.

The Personalization

Your bank knows more about your financial responsibility than any credit score could. They see you pay your utility bills on time. They see you maintain a healthy saving buffer. In an integrated banking insurance model, this data can be used (with your permission) to prove you are at a lower risk.

The Trust

You trust your bank to protect your life savings. You trust them to stop hackers from draining your account. Why shouldn’t you trust them to insure your home? Data shows that 50% of consumers trust banks more than any other entity to protect them from fraud. This high-level security infrastructure extends to integrated banking insurance.

If you are still mailing checks to an insurance agent, it is time to upgrade. Log in to your banking app, and you might be surprised to find that the best policy for you is already waiting there, powered by the logic of integrated banking insurance. Your time is worth more than the paperwork.